Is Lawsuit Funding Better Than a Personal Loan After an Injury?

Suffering an injury creates immediate financial pressure that doesn’t pause during recovery. Medical bills arrive while you’re unable to work. Meanwhile, rent, utilities, and daily expenses continue demanding payment without relief. Deciding between lawsuit funding vs loans requires understanding fundamental differences between these options. Many injured plaintiffs feel confused about which choice protects them better. Bills don’t stop during recovery, creating urgency that leads to rushed decisions.

Choosing the wrong funding option can worsen financial stress significantly during already difficult times. Understanding how each option works helps you make informed choices. This guide explains everything you need to know about lawsuit funding vs loans after suffering injuries. Any Lawsuits provides transparent, non-recourse funding throughout Florida for personal injury plaintiffs during their legal battles. We help injured victims understand their financial options clearly.

Why Injured Plaintiffs Compare Lawsuit Funding and Personal Loans

After accidents, many plaintiffs ask: “Which is safer after an accident?” Others wonder: “What if I cannot work for months?” These concerns drive comparisons between lawsuit funding vs loans options. Lost income after injury creates immediate financial crises for most families. Regular paychecks stop while medical expenses continue mounting rapidly. Medical bills and daily expenses demand attention regardless of case timelines.

Financial urgency leads to rushed decisions about borrowing without understanding consequences. Many plaintiffs choose quickly without comparing terms or understanding risks. However, taking time to evaluate both options protects your long-term financial health significantly.

How Lawsuit Funding Works After an Injury

Lawsuit funding provides non-recourse advances to plaintiffs with pending personal injury cases. Pre-settlement funding is a non-recourse lawsuit cash advance offered to plaintiffs based on the value of their legal case. This funding is based on case strength rather than personal credit history.

Because pre-settlement cash advances are a type of non-recourse loan, you don’t have to pay back the funds if you lose your case. Repayment happens only if you win through settlement or trial verdict. If your case fails, you owe nothing to the funding company.

High Rise Financial bases funding approval strictly on the facts of your personal injury case. Your credit score doesn’t affect eligibility for lawsuit funding approval. Employment status and income verification aren’t required for these advances.

Most applicants who are approved will have cash within 24 to 48 hours after approval. Fast turnaround addresses urgent financial needs during injury recovery periods.

How Personal Loans Work After an Injury

A personal loan functions like any standard lending product: you apply, your credit and income are evaluated, and if approved, you make monthly payments with interest until the debt is repaid. Traditional lending products require extensive documentation and qualification standards.

Credit checks are required for all personal loan applications without exception. Lenders evaluate your credit history, income, employment, and existing debt obligations. Poor credit scores result in denials or extremely high interest rates.

Monthly payments start immediately after receiving personal loan funds regardless of your financial situation. You must pay every month even while recovering from injuries. Income verification is needed to prove your ability to make consistent monthly payments.

With a personal loan, you carry all the risk—if the case fails, you still owe the lender. Repayment is required even if your case fails or takes years to resolve. This obligation creates significant financial risk during uncertain litigation periods.

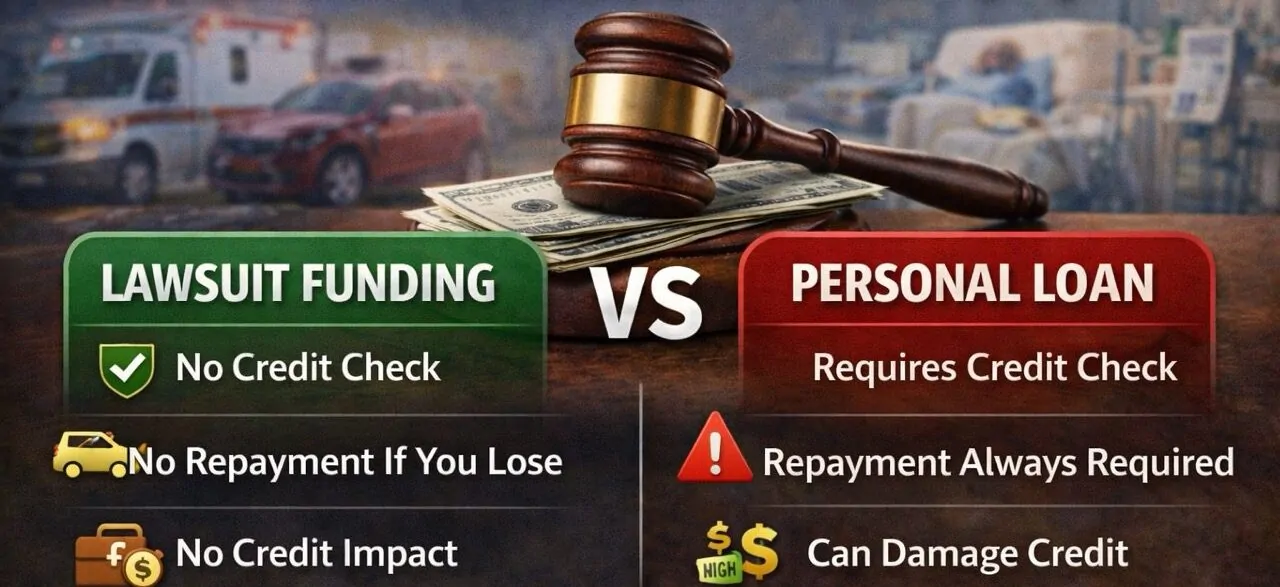

Lawsuit Funding vs Personal Loans: Side-by-Side Comparison

Understanding lawsuit funding vs loans differences requires clear comparison of key factors affecting injured plaintiffs significantly.

| Factor | Lawsuit Funding | Personal Loans |

|---|---|---|

| Credit Check | Not required for approval | Always required |

| Monthly Payments | None during case | Required immediately |

| Repayment Risk | Only if you win | Always required |

| Credit Reporting | Never reported | Always reported |

| Approval Speed | 24-48 hours | 1-4 weeks |

| Impact If You Lose | Owe nothing | Still owe full amount |

Why Lawsuit Funding Is Often Safer After an Injury

Lawsuit funding avoids personal debt obligations that traditional loans create during uncertain times. If there’s no settlement, you owe nothing. This protection eliminates risk of additional financial burden if cases fail. No credit damage occurs from lawsuit funding applications or case outcomes. Pre-settlement funding avoids this entirely because it never appears on credit reports. Your credit score remains unaffected regardless of what happens with your case.

No collections calls or legal actions can pursue you for unpaid advances. Funding companies cannot garnish wages or place liens on personal property. No wage garnishment attempts occur after unsuccessful case outcomes ever. Reduced stress during recovery allows you to focus on healing and case development. Financial stability from non-recourse funding provides peace of mind during litigation. You can pursue maximum compensation without pressure to settle quickly.

When a Personal Loan Might Make Sense

Not everyone needs lawsuit funding despite injury-related financial pressures. Some situations make traditional personal loans more appropriate choices. However, these scenarios are relatively rare for injured plaintiffs. Strong stable income from sources unaffected by your injuries might support loan repayment. Short recovery periods allowing quick return to work reduce repayment risk. Stable savings providing emergency cushions make loan obligations more manageable.

However, there’s significant caution to consider here. Risk exists if your case is delayed beyond expectations unexpectedly. Personal injury cases often take 18 to 24 months or longer to resolve. Missing loan payments during extended litigation damages credit and creates additional stress. Most injured plaintiffs benefit more from lawsuit funding vs loans due to non-recourse protection eliminating personal financial risk completely.

How Lawsuit Funding Can Protect Your Credit

Lawsuit funding helps you maintain good credit by providing funds to meet existing obligations. Paying rent on time prevents eviction and negative credit reporting from landlords. Maintaining housing stability protects credit scores during litigation periods. Avoiding credit card debt stops interest accumulation and minimum payment obligations. Credit cards charge high interest rates that compound financial problems quickly. Using lawsuit funding instead of maxing out credit cards preserves available credit.

Preventing missed bills maintains positive payment history on credit reports. Utility payments, car loans, and other obligations continue on time. Late or missed payments can have long-lasting consequences, reducing your credit score. Lawsuit funding prevents this damage entirely. Understanding how lawsuit funding vs loans affects credit helps you make strategic financial decisions during injury recovery periods.

Common Mistakes to Avoid When Choosing Between the Two

Many plaintiffs make avoidable errors when evaluating lawsuit funding vs loans options for their injury situations.

Common mistakes include:

- Choosing speed over safety by accepting first loan offer without comparing non-recourse funding options

- Ignoring repayment terms that create monthly obligations impossible to meet during recovery periods

- Using credit cards first instead of exploring safer lawsuit funding options with no repayment risk

- Not speaking with your attorney about financial needs and funding options before making decisions

Why Choose Any Lawsuits for Injury-Related Funding

Any Lawsuits provides specialized injury-related funding with experienced Florida-based team members. Our local experts understand personal injury law and financial pressures plaintiffs face. Fast approvals within 24 to 48 hours address urgent financial needs quickly. No credit checks are required for approval decisions based solely on case merit. Your financial history doesn’t affect eligibility for advances at all. Direct deposit gets funds to you immediately after contract signing.

Non-recourse protection eliminates repayment obligations if your case doesn’t succeed. You owe nothing if your case fails or settles below expectations. Transparent terms explain all fees clearly before you sign contracts. We help Florida residents understand lawsuit funding vs loans differences and choose the safest option for their situations confidently.

Lawsuit Funding or Personal Loan After an Injury?

For most injured plaintiffs facing financial pressure during litigation, lawsuit funding offers significantly safer protection. Non-recourse structure eliminates personal financial risk completely. You owe nothing if your case doesn’t succeed favorably.

Personal loans create monthly payment obligations during uncertain recovery periods. Missing payments damages credit and creates collection actions against you. The risk often outweighs benefits for injured plaintiffs. Understanding lawsuit funding vs loans helps you choose the option protecting your financial future best during challenging times.

Contact Any Lawsuits Today

📍 23257 N State Rd 7 #105, Boca Raton, FL

📞 (877) 386-3379

📧 admin@anylawsuits.com

Apply today to explore risk-free lawsuit funding options and protect yourself from personal loan obligations during your injury case.